I know some people are going to read this — or read the title and nothing more — and jump to the conclusion that I’m just a liberal bashing the troops. Nothing could be further from the truth. My dad served in World War II and came home with undiagnosed PTSD that derailed his life for several years. One of my uncles lied about his age, enlisted in the Navy at 15, and died on board a submarine in WWII. My grandfather-in-law died leading his unit through a French farm field in World War I without ever getting to see or hold his infant son (who eventually became my father-in-law). I respect the people who serve in the armed forces.

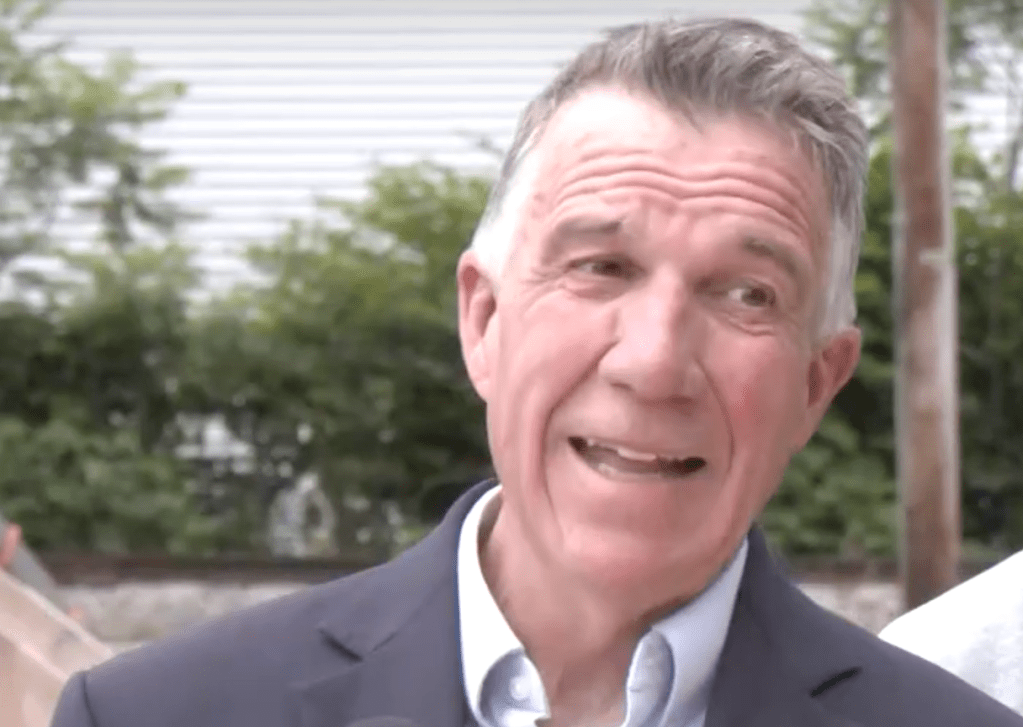

But this tax exemption for military pensions that just became law in Vermont has nothing to do with the troops. It’s the officer class who will reap most of the benefits, and most of them are quite comfortable already. I don’t recall anyone bringing this up during the years-long debate over the exemption, which has been strongly pushed by Gov. Phil Scott.

Hell, I wouldn’t know about this if not for political cartoonist and Vietnam vet Jeff Danziger, who emailed me about the military pension system — in particular, who qualifies and who doesn’t.

In order to earn a military pension, you have to serve 20 years in the military. This includes most officers and some NCOs. It excludes the grunts, the people who do the fighting and shoulder most of the risk. It would not have included my dad or my grandfather-in-law’s surviving widow and son — or former Lt. Danziger, who “only” served four years in the Big Muddy. (His Vietnam memoir, Lieutenant Dangerous, is highly recommended.)

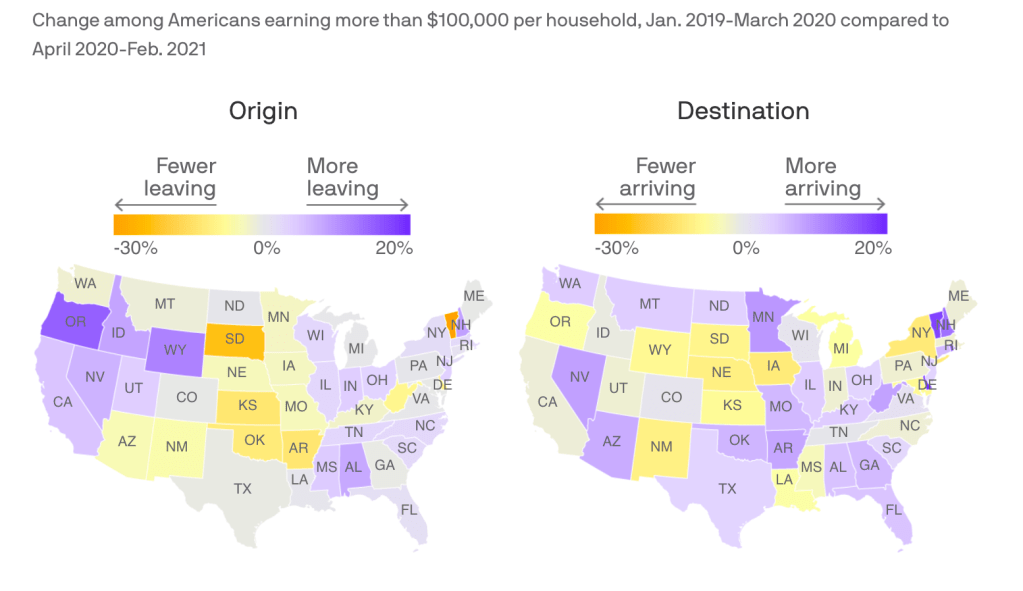

In other words, the military pension exemption is largely a giveaway to the affluent.

Continue reading