Recently I had the opportunity to sit in on an update and short-term forecast of the economy and the markets. It was an exercise in what they call “wealth management” — stewardship on behalf of the well-to-do. I did so as an investor with retirement funds in the markets, who’s been feeling a fair bit queasy about the chances that Donald Trump’s doggedly anarchic policies might cause everything financial to drop straight into the toilet.

Well, I have some very good news wrapped in a bad-news burrito.

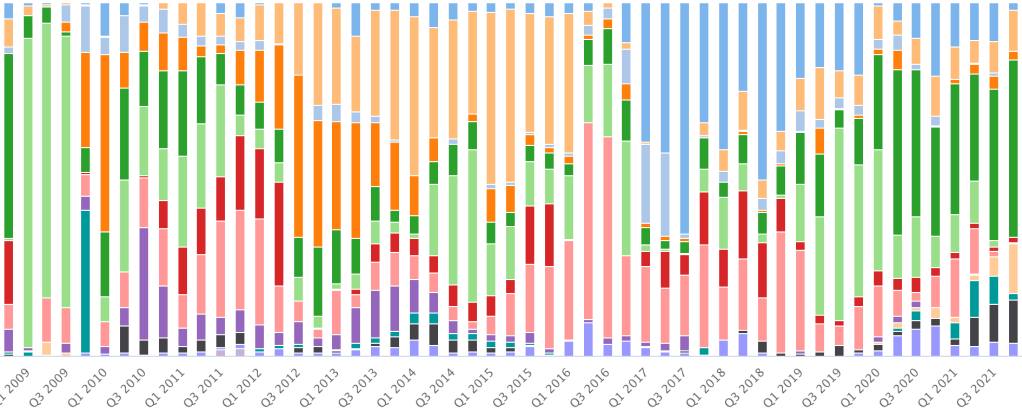

The good news, from this analyst’s perch: The economy is doing pretty well, actually. It has weathered Trump’s reign of error because of some very strong fundamentals. Also because deregulation and tax cuts are business-friendly. By every measure, the outlook is positive.

In the aggregate, that is.

But within the aggregate, there are distinct winners and losers. I bet you can guess who falls into which category.

Continue reading