I saw “The Big Short” last night. Great movie. Manages to be funny and dramatic while also explaining some very tricky financial concepts.

And there was one scene near the end that reminded me very much of The Man Who Would Be Governor, Bruce Lisman. He’s the native Vermonter who spent most of his adult life in the shadowy canyons of Wall Street, working his way up the ladder to the very top ranks of Bear Stearns.

Yes, the financial firm that went kerblooey in the great crash of 2008.

The story of “The Big Short” is that a few marginal investor-class weirdos were the only ones who saw how the mainstream investment community was vastly overextended in the housing market — to such an extent that a crash was inevitable. It also features various Wall Street “geniuses” who were clueless about the coming debacle.

Here’s a key scene in the film. Dramatis personae: Mark Baum, oddball hedge-fund manager who saw the crash coming; and Bruce Miller, Wall Street insider. They are debating each other on the truth or fiction of the housing crash — just as it begins to happen.

Miller, a shortish gray-haired man with a receding hairline, bears an unfortunate physical resemblance to Bruce Lisman. But the more important resemblance is the message each man delivered.

First, “Bruce Miller” responds to Mark Baum’s baleful warning. During which, every cellphone in the room has started pinging ominously.

THE HOST Does our bull have a response?

BRUCE MILLER Only that in the history of Wall Street, no investment bank has ever failed except when caught in criminal activities. So I stand by my Bear Stearns optimism.

[A YOUNG BANKER stands, unwilling to wait for the Q & A.]

YOUNG BANKER Mr. Miller! Sorry. Quick Question. [consults his Blackberry] From the time you guys started talking, Bear Stearns stock has fallen more than 38 percent. Would you buy more now?

BRUCE MILLER [pause] Sure. Yeah. I’d buy more. Why not?

[Awkward silence.]

MARK [whispering] Boom.

[The whole room scrambles for the exits.]

Ha-ha, oh what a knucklehead, that Bruce Miller. A captive of conventional wisdom, unable to see the end of his world staring him in the face.

And now, real life. From a Wall Street Journal account of Bear Stearns’ last days:

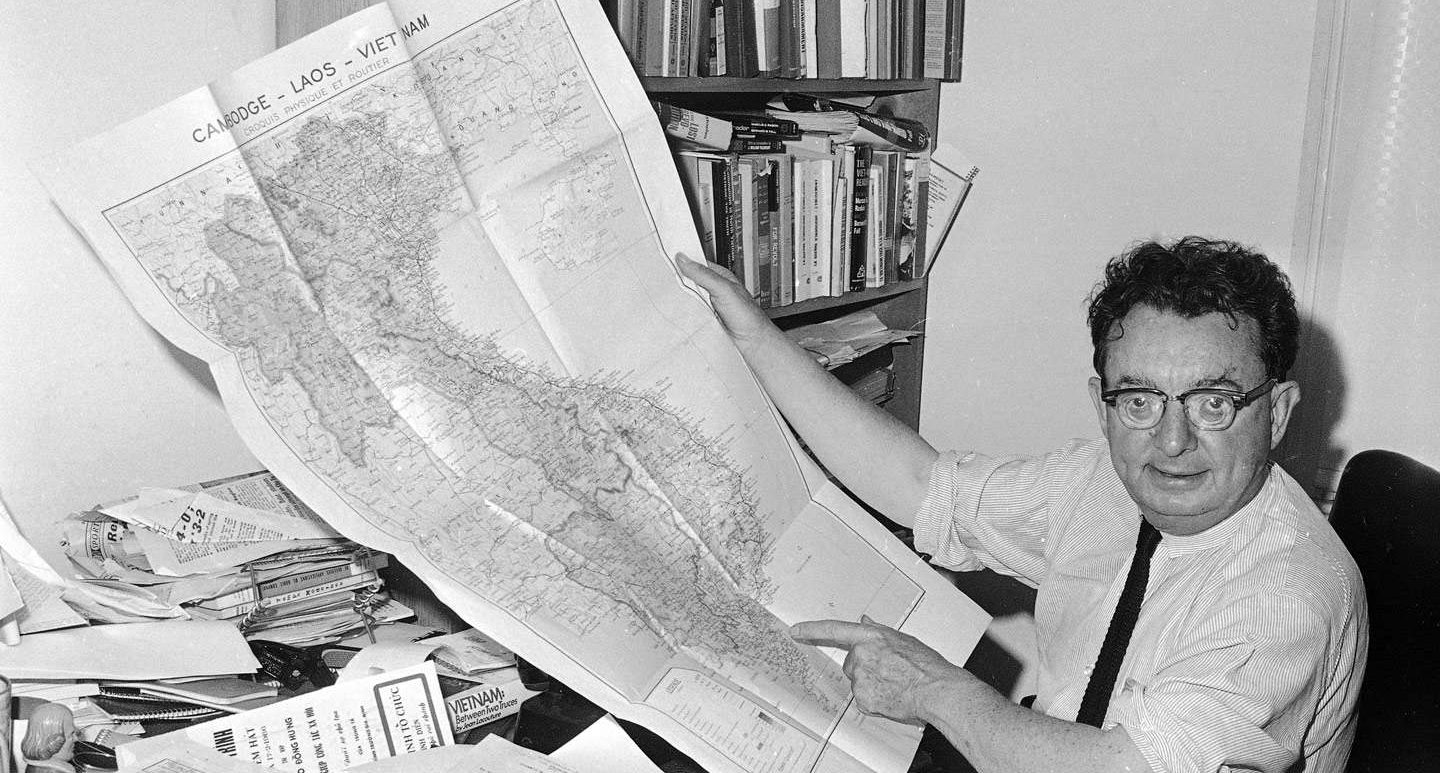

In the middle of the afternoon, Bruce Lisman, the usually taciturn 61-year-old co-head of Bear Stearns’s stock division, climbed atop a desk near his fourth-floor office and demanded his traders’ attention. “Let’s stay focused,” he bellowed. “Keep working hard. Bear Stearns has been here a long time, and we’re staying here. If there’s any news, I’ll let you know, if and when I know it.”

Bruce Lisman, captive of conventional Wall Street wisdom, giving false words of assurance that echo those of “Bruce Miller.” Within a few days, Bear Stearns would no longer exist. And the meltdown was on, causing Americans to lose trillions in equity and (in too many cases) their homes and futures.

I’m not saying that Lisman was culpable. I’m not saying that a whole lot of people didn’t share his lack of foresight. What I am saying is that Lisman’s Wall Street experience tells us nothing about his fitness to be Vermont’s chief executive.

Lisman has insisted he had nothing to do with the sectors of Bear Stearns that brought the company down. And he’s right. But where was he when the shit hit the fan? Issuing full-throated but ultimately hollow reassurances to his workforce.

In the years since 2008, the bankers and investors and rich guys and their apologists have muddied the waters and done their best to divert blame. But here’s the bottom line from the end of “The Big Short” — the real cost to Americans like us.

“When the dust settled from the collapse 5 trillion dollars in pension money, real estate value, 401k, savings, and bonds had disappeared. 8 million people lost their jobs, six million lost their homes. And that was just in the USA.”

This may sound harsh, but a tiny fraction of those lost trillions is currently in Bruce Lisman’s wallet. He was part of that system. He profited mightily from it. He failed to see the bad stuff coming. Why should I have any faith in his financial insight, his managerial ability, when he was on the bridge of the Titanic and didn’t see the iceberg?

Glad that someone said it. Thank you.

Why do you assume he failed to see the bad stuff coming? Didn’t he make out well on the deal?

This is on my to-see list. Thanks. I did read the book. We, my wife and I, were visiting our oldest son in LA. He took me to “The Last Bookstore.” He was telling me about it on our walk from our hotel through downtown. Said the staff is very knowledgeable about their inventory and books in general. I went to the info desk and asked about anything that they had in-stock that might help to explain what the Great Recession was all about. The person responded, “Oh my gosh, this just came in.” He instructed me to follow him and we weaved through the shelves to somewhere and he bent-down and pulled “The Big Short” off he shelf, and said, “This should shed a little light.” He was right. Mr. Lisman is culpable. They all are.

Guilt by association in this and the piece on Cathrine Nelson. It’s the same BS logic that republicans used to label the president as a radical after his brief association with Bill Ayres. You can do better John.

I’m not saying she’s guilty. I’m not even saying they should rethink her promotion. I am saying that the community deserves more information from Nelson and the Mitchells.

By now we all can plainly see BHA IS a radical but not really the worst thing he could be called imo, and are now far more guilt-by-associations than those of us with eyes open following the maany eyeopeners care to see. Suggest you remove blinders sir as there’s now much more than mere tame GBA. I was also a true believer until eyes opened and have seen enough.

Using BHA or Catherine Nelson as example of GBA-wow! Ya may have better made point using OJ. I must say defending VP, CEO after 10-year stint at VTs best paper, even if it’s only by comparison b/c the rest suck, following what has transpired a bit strange.

May I wonder, w/o offending one’s sensibilities, what a member of and heading up fuddy-duddy civic orgs and VT foundation, whose drinking buddy, a lifelong career criminal which includes violence, heroin dealer in heroin-hotbed during a heroin epidemic have in common? Especially since entire criminal history is contained in and published by the Rutland Herald which would have been impossible for Nelson NOT to have known.

Another commenter who reports Nelson dating Hance, alleges he is still a well-known VT heroin dealer whether, he is still ‘active’, not the point, perception esp if earned do matter. So in VT premiere designation as “dangerous city” city, is he too “passing judgement”? And, the beau would not be available to throw ’em back with, as he would have been in the Graybar with a lifelong jail sentence after meeting qualification as career crim, if he were anywhere but VT with our crime-enabling judges. May I suggest judges should be jailing heroin dealers, at least until epidemic is passed.

http://www.city-data.com/forum/vermont/1088461-gangs-vermont.html

http://www.rutlandherald.com/article/20160105/THISJUSTIN/301059993/0/rh_widesky_business.vermonttoday.com

Sherlock not needed here. May I suggest you bone-up on childhood games such as what’s-wrong-with-this-picture, connect-the-dots etc as this is all any average-IQ needs to see here.

And no, though well qualified skill set, not ready to move up at this time since there is a year of probation typically including drug & alcohol testing. What a community and readers think and percieve is something a family-owned newspaper should care about.

And no, Ms Nelson has not “taken responsibility” either.

I wonder what his vision of Vermont is. An investors paradise? A tax haven for the uber rich? With possibly a little “trickle-down” for the peasants. Reagan proved that this doesn’t work. To bad nobody wants to listen.

Wall Street guys caused the recession. Lisman was a Wall Street guy. So, he’s unqualified.

Sounds like Trump’s logic. Surely you can be more insightful than that!

Shorter Bruce Lisman: Greed is Good! Don’t tell the peasants, or they’ll stop being our feedstock. Whoops. How’d that cat get out of the bag?

America, circa 2016: Owned By Cheaters. Because, frankly, democracy has in fact been usurped by capitalism. We have Owners, now. Let the scales fall, people.